| Home Invest in Nigeria Business Areas Organization References Contact |

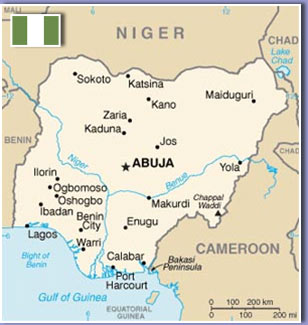

Federal Republic of Nigeria

|

PROFILE

People

Government Type: Federal republic. Independence: October 1, 1960. Constitution: The 1999 constitution (based largely on the 1979 constitution) was promulgated by decree on May 5, 1999 and came into force on May 29, 1999. |

||||||||||||||||||

| Seven Reasons to Invest in Nigeria Nigeria offers significant advantages to potential investors: 1. Abundant Resources Nigeria has enormous resources, most of which are yet to be fully exploited. They include mineral, agricultural, and human resources. 2. Large Market Nigeria offers a market with a growing population of about 153 million people. The Nigerian market potential also stretches into the growing West African sub-region. 3. Political Stability Nigeria offers a stable political environment. 4. Free Market Economy The Government has created a favourable climate for business and industrial ventures. Administrative and bureaucratic procedures have been greatly streamlined. The Government has put in place policies and programmes that guarantee a free market economy. 5. Robust Private Sector The country has a dynamic private sector, which has assured greater responsibilities under the new economic environment. 6. Developed Banking There is a well-developed banking and financial sector. The investor has easy access to working capital and other credit facilities. 7. Skilled and Low Cost Labour There is an abundance of skilled labour at an economic cost, resulting in reduced production costs, which are among the lowest in Africa. Invest in Nigeria In 2008, Africa’s most populous country, Nigeria made great strides towards economic and political progress, and there is no indication that the speed with which the nation is transforming is dissipating anytime soon. Thankfully and just in time, Nigeria 2005 banking consolidation has resulted in a more sound and stable financial sector ready to weather the challenges of the current global financial crises. Nigeria is now officially not only Africa’s fastest but also the world’s eight fastest growing telecommunications environment, with 57 million connected subscribers and a monthly growing rate of 1.1 million new sign ups. The federal government is seriously committed to developing the country‘s tremendous agricultural potential with the introduction of Nigeria’s National Food Security Programme. This in the light of the world food crises is poised to attract international attention. The Oil & Gas sector, producing Nigeria’s prime export good and generating more than 90 per cent of the country foreign exchange earnings, has continued to thrive despite the Niger Delta issue. Nigeria’s quest to attract investors to its USD 30 billion Gas Master Plan has drawn the unprecedented interest of major foreign gas and oil companies. Nigeria’s proven oil reserves are estimated to be 36 billion barrels. Natural gas reserves are at least 100 trillion cubic feet (2.8 trillion cubic metres). Foreign direct investment in the country (mostly in oil related fields) is expected to stay high too, at over USD 10 billion per year. The south, or Guinea coastlands, is the most economically developed part of Nigeria. All of the country’s major industrial centres and oil fields, as well as its seaports, are concentrated in this south region, including its intensively exploited forest resources. Last but not least; democracy has marked a few significant victories, with the judicial due process and the Economic and Financial Crimes Commission actively pursuing transparency and accountability. All the indications confirm that Nigeria remains Africa’s prime investment destination. Despite the global financial crises, the country was named the least vulnerable economy in the world, according to a report compiled by a team of experts from Merrill Lynch in November 2008. Government Incentives for Investors

Companies that export at least 50 per cent of their annual turnover minimize their tax burden.

Companies can achieve an extra 5 per cent write-off on plant and machinery if they export 50 per cent of their annual production abroad. Furthermore, 40 per cent of the raw materials used must come from Nigeria.

Investment in mining stay tax-free for three to five years, it benefits from tax deferment for large projects, financial research grants, funded infrastructure (roads, electricity, etc) and write-offs for companies that that are 100 per cent foreign owned.

Seven years tax exemption and an extra 5 per cent write-off on real estate are granted to companies that set up in underdeveloped regions.

Companies that do research work in Nigeria can claim 120 per cent of their expenses against tax.

Companies that use resource-saving methods are guaranteed tax allowances of 30 per cent over five years. Each industry has different criteria: agricultural companies must use at least 80 per cent Nigerian raw materials, machine manufacturing and chemical production facilities require a usage of 60 per cent Nigerian raw materials, petrochemical companies need a production quota of 70 per cent. 15 per cent tax reductions are granted to companies that employ more than 1,000 people. Companies that export more than 60 per cent of their overall annual production receive a 10 per cent reduction for 5 years. A 2 per cent tax allowance is given to employers that carry out in-house training.

|

|||||